The industry guide to householding

Account aggregation is table stakes. Our industry has been working up to an aggregated view of all accounts in a household for years. The trend finally caught on, but we quickly learned that a view is not enough to improve outcomes for clients. This view needs action.

Table of contents

Click one of these options to go directly to that section of this guide.

- Intro to householding

- What is householding?

- Householding and why it’s important now

- Household management essentials

- Improving investor outcomes through householding

- Why advisors should adopt a householding approach

- Benefits of householding for advisors

- Why is householding important for investors?

- What advisors should do now

Intro to householding

Householding is a single view of all accounts within a household.With a smart-householding strategy, we take this aggregated view of accounts to the next level. If you could wave a magic wand and:

- Ensure investors would enhance their financial outcomes without additional risk…

- Creating a solid foundation for the future…

- Resulting in a more efficient and profitable practice… and

- A win-win-win was created for you, your clients and prospects, would you do it?

Of course.

EY, Vanguard, Envestnet and Morningstar have done studies showing tax-smart household-level portfolio management or “smart-householding” improves investor financial outcomes. A lot. And as a result, advisor outcomes are improved too.

What is householding?

Managing a portfolio of investments and protection products that are:

- Held in different account types

- Managed in a coordinated way optimizing risk and tax

- Improving financial outcomes

- Quantifying the benefits in dollars and cents

Here’s what it boils down to: Smart-householding is a strategy to identify and implement the tax-smart location for every asset in a household portfolio.

Householding and why it’s important now

For decades the industry’s infrastructure has been designed for transactions and product sales, not smart-household management. But that has changed. The typical investor has five or six accounts, two or three advisors and multiple custodians. Studies show most investors accumulate assets haphazardly – different products are purchased at different times from different advisors with little attention to managing the full portfolio in a coordinated and optimal way.

Enter: asset location.

While most advisors focus on household-level asset allocation – at least initially – rarely is tax-smart asset location meaningfully considered. In fact, studies show that too many assets are held in the wrong account registrations. And advisors say withdrawals from multiple accounts are a “thumb-nail” exercise at best.

Householding is a rapidly growing trend toward operationalizing household-level advice. It’s being embraced as investors and advisors are reminded that markets go up and down, but goals remain the same. The mark of the prudent investor and wise advisor is to seek sound ways to improve portfolio outcomes through all market cycles.

There are three ways to improve portfolio outcomes:

- Reduce costs

- Manage risk consistent with objectives

- Minimize taxes*

We’re going to focus on the third option here.

Improving outcomes through tax-smart asset location

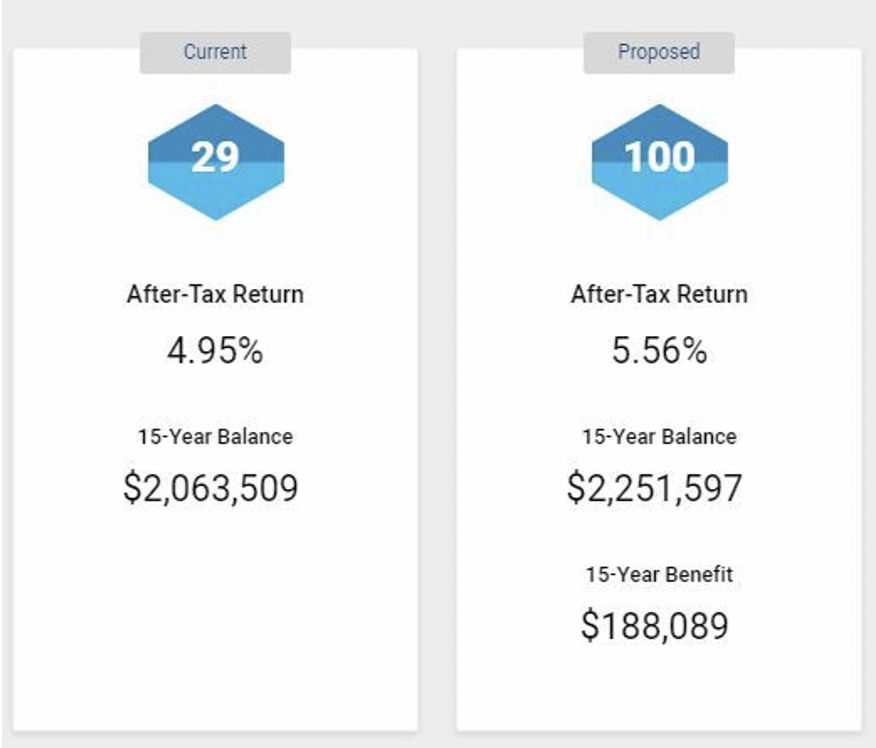

A $1 million household with a 50% bonds/50% equities and 50% qualified and 50% taxable would realize after-tax gains through tax-smart asset location of:

- $97,000 improvement over first 10 years

- $188,000 over 15 years

- $324,000 over 20 years

NOTE: A modern wealth ecosystem is key to differentiating yourself as an advisor. Dive into each element of an optimized advisor technology stack in this whitepaper.

Household management essentials

The critical elements of Smart-household management include:

Account aggregation

Account aggregation and householding are not synonymous. Account aggregation is a birds-eye view of all assets owned by the client. It’s a good and necessary first step, but the managing assets in a coordinated and optimal fashion is required to improve results.

Advisors should ask, “Am I viewing a client’s household portfolio, or am I implementing at the household-level? Account aggregation is a view – vitally important – but more is needed. Household level management occurs when all accounts and holdings are managed in an optimal fashion to improve outcomes and can be quantified in dollars and cents.

.png)

Coordination at the household level

Householding improves results from accumulation through withdrawal and bequest in the following ways:

-

Tax-efficient portfolio management

Taxes are the single largest cost an investor incurs. A recent study shows investors are half as tax efficient as they could be. * This is the statistic that we did on Envestnet’s business that shows investors are half as tax efficient as they could be. We may need to do a post on this and then link to that study) -

Risk management consistent with client tolerance

All agree risk management is fundamentally important, but too many portfolios are not in synch between risk, comfort level and goals. Managing the full household portfolio optimally mitigates risk. -

Reduce investment cost

As costs go lower each day, it’s a reminder: “cost is an issue in the absence of value.” We will show ways to add real value and earn what you charge.

An EY study showed investors can improve outcomes by 33% from accumulation through income to bequest. This can only be realized by taking actions across all investor holdings.

Taking action on the 10,000-foot view

Financial Planning is critical. But planning without implementation is just a plan. The concept of “Planning-to-Action” is gaining traction as we know we can’t spend a plan. We can only spend outcomes. An EY study showed investors can improve outcomes from accumulation through income to bequest by 33%. This can only be realized by taking actions across all holdings.

Improving investor outcomes through householding

As markets change, the levers to improve outcomes need to be employed to reduce portfolio drag. By improving after-tax returns over time, investors are more confident, which builds trust. The consistent result, advisors report: clients consolidate assets.

A householding approach creates multiple opportunities for advisors to increase a household’s tax efficiency. These are the levers you can pull to deliver improved results:

- Asset allocation – Each account has its own discrete asset allocation, which rolls up to the target household allocation. Smart-householding starts with managing risk at the household level.

- Tax-smart asset location – Portfolios include different account registrations and holdings, all with different tax treatments. Tax-smart asset location is achieved by managing accounts and holdings optimally, so asset allocation and risk are maintained while assets are located in the most beneficial accounts. Risk-smart, tax-smart asset location produces improved after-tax outcomes for both advisors and investors.

- Tax-loss harvesting – Tax-loss harvesting is a useful strategy that improves a client’s short-term tax efficiency. The objective is to reduce a client’s cost basis in positions held in non-qualified accounts. But this strategy only kicks the can down the road where the client’s tax rates could be lower in the future. For clients already in retirement and living off savings, this strategy can be used in a dynamic way to reduce taxes paid when raising cash to support a client’s spending. Software exists to look across all the accounts in a household to harvest losses, while raising the required cash to produce tax-smart retirement income.

- Tax-smart household rebalancing – Household rebalancing allows an advisor to set a target asset allocation and spread that allocation across the multiple accounts in the household portfolio. This strategy maintains the desired risk and asset location targets as markets and circumstances change, ultimately keeping a client on track while improving their after-tax returns. Most rebalancing tools do not take a custom approach to rebalancing at the household-level that includes optimizing for asset location. LifeYield helps to facilitate household rebalancing, including automated location preferences to provide a custom result for each client.

- Model assignment – Single account models are not designed with household coordination in mind. To optimally manage a full portfolio, models should work with the other holdings in the household. When done effectively, model assignment optimizes asset location while respecting the asset allocation targets across different models and holdings. The process of model assignment is simply defining the target for the group of accounts and assigns model allocations to each account in the most tax efficient ways. The result is better financial outcomes versus applying the same asset allocation to each account.

- Social Security maximization – The first question investors ask as they near retirement is, “when should I take Social Security and how should I file?” Once determined, the investor feels better and wants to know what to do to maximize accumulation, income and/or bequest. It’s important to understand all layers of a client’s income to answer the follow-up questions, “How does this fit into my income needs?” and “What can we do about any potential shortfalls?” Income and estate planning strategies can be considered on top of Social Security benefits to create a plan to maximize the entire household’s income over time.

- Household-level tax-smart retirement income – The ideal for investors and advisors is to determine the optimal sequence of withdrawals to maximize household assets across all accounts and income sources, including Social Security. When done well, the following occurs:

Why advisors should adopt a householding approach

The key reasons advisors develop a householding approach are:

-

Position your practice to deliver better outcomes in the new reality

While investors have been oriented around “performance” is the way to get ahead, a new definition has emerged as a result of our new reality and advances in technology. Householding puts the advisor in the driver seat to go beyond performance, which they cannot control, and embrace the levers to improve outcomes, which they can.Challenging markets have put money in motion. For investors who aren’t sure where to turn, smart advisors are using tax-loss harvesting, tax-smart asset location, household rebalancing and multi-account income optimization to generate alpha. These advisors are growing their business in the face of uncertainty as money is moving and they can demonstrate their true added value.

-

It’s a “must have” to maximize retirement income

The #1 objective as investors approach retirement is income they can’t outlive – income which necessarily must be drawn from the full portfolio of accounts and sources. There is no better way to increase income than by being tax-smart, risk-smart and cost-smart. Morningstar says investors can improve outcomes by 183 basis points per year through comprehensive management. There is real value in developing an actionable execution plan that demonstrates enhanced value. -

Differentiate your practice and demonstrate clear value

Cost is an issue in the absence of value. With the ability to quantify the projected dollars and cents alpha that can be achieved through householding, advisors report they can answer the nagging objection of “why am I paying so much?”Demonstrating your value across a client’s full portfolio sets you apart from your peers. Advisors tell us the new reality has made it imperative to embrace household level management in retaining clients, consolidating assets and adding disaffected investors to their book.

-

Save time and enhance practice efficiency

A study of 100 RIAs by the Boston Research Group found it takes up to three hours to manually determine from which accounts to draw one check, one time. Technology exists to automate the process, manage thousands of client household accounts efficiently and effectively, and add real, quantifiable value. -

Increase AUM, revenue, retention, referrals, consolidation and profitability

Tax savings equate to increased assets and revenues for the advisor. As EY highlights, investors can see a 33% improvement over an investor’s lifetime. That translates to a dramatic improvement in advisor revenues as fewer assets are needed to pay taxes. And as retained assets grow and compound, it’s a win for both investors and advisors.

Smart advisors are growing their business in the face of uncertainty as money is moving and they can demonstrate their true added value.

Benefits of householding for advisors

Advisors report significant benefits from embracing householding. When adopted, advisors can:

- Increase AUM and firm revenue

- Enable investors to grow assets more rapidly

- Show clients how to maximize retirement income

- Create a better user experience leading to greater client confidence and loyalty

- Differentiate their practice with a unique investment approach

- Quantify the value of their strategy

This leads to enhanced client retention, increased opportunities for consolidating assets and more referrals.

The result? A more effective, efficient and profitable practice.

The industry’s top advisors are finding success using the LifeYield Advantage Suite®. See how Steven Elwell, CIO at Level Financial Advisors, is helping to minimize investment taxes and quantifying the impact of his strategy for each client.

Why is householding important for investors?

Householding provides a roadmap to improve outcomes over time. Because investors tend to accumulate multiple accounts, products, advisors and custodians – and have no ability optimize their holdings – no investor can maximize household-level returns and income on their own.

The advantages for investors who are guided by an advisor are clear:

- Financial outcomes are improved due to tax-efficient household-level management

- Risk is managed consistent with objectives and comfort level

- Costs are often reduced as assets consolidate

Investors value that kind of advice, which creates a deeper, more long-lasting relationship.

Quantifying your value for clients

If a tree falls in a forest and no one is there to hear it, did it make a sound? While many advisors work to optimize asset location and create tax-smart retirement income, unless you can quantify the results, did it really happen?Quantifying the financial benefit of your strategy, in this case, tax-smart asset location, is vital to building investor confidence and demonstrating your value.

At LifeYield, we quantify the results of your householding strategy like this:

In this case, we have a $1 million household with a 50% bonds & 50% equities and 50% qualified & 50% taxable. Our analysis clearly shows that you can achieve a 15-year benefit of over $188,000 when you locate the right assets in the right accounts.

Make sure any software you use to solve complex problems for investors has features to help you explain the strategy. A score is a great way to guide client conversations and consistently benchmark yourself against something that you can control beyond investment performance.

What advisors should do now

The connection between the client experience, the integration of technology and the ability to improve outcomes will take advisors and their clients into the future of advice. This shift enables advisors to shape their practice to meet the demands of today’s and tomorrow’s investors while growing their business in more efficient and profitable ways.

Here is the 5-step process for adopting smart-householding:

- Put yourself in the right mindset to act on your aggregated view of a client’s accounts

- Perform a tax-efficiency audit for each client

- Identify and implement the tax-smart location for every asset

- Explain your methods and results to each client

- Offer the same level of advice to friends and family

Smart-householding is a clear win-win for advisors and investors. All the necessary elements exist. Successful advisors are shifting their mindset and operational strategies from “the way it’s been” to a method that delivers a holistic, enhanced, household-level advice experience.

Monthly insights from our Chief Growth Officer, Jack Sharry

Get exclusive insights and interviews from around the industry