Multi-Account Rebalancing

The industry is moving towards a household approach to wealth management, which is the ability to aggregate, coordinate, and tax-optimize all accounts and holdings within a household.

Householding is the next big step for wealthtech platforms. Once adopted, your firm can now manage a portfolio of investments and help clients:

- Pay less taxes on assets held in different account types

- Manage portfolio risk and tax optimization in a coordinated way

- Improve financial outcomes

- Quantify the benefits in dollars and cents

Rebalancing has typically been executed account by account. If an investor only has one account, this can be a suitable strategy. But most investors own many accounts spread across multiple investment programs and custodians, each with different tax treatments. Rebalancing has not been approached at the household level, until now.

A rebalance is not a simple task anymore for many clients. And if you’re managing accounts at the household level, it’s very time-consuming without the right technology. Now, you can rebalance with tax-smart household-level technology making it possible for your firm to improve client financial outcomes and quantify the impact in dollars. This is the gold standard of rebalancing solutions today.

What is Rebalancing Client Assets?

Rebalancing involves the periodic buying and selling of assets within a portfolio to maintain the original or desired allocation or risk. In most cases, a portfolio will be divided into categories. Depending on the client’s goals, there may be multiple categories or a simple stocks/bonds type relationship within the portfolio.

To start with an easy example, we can look at the stocks/bonds relationship. Say a client wants a 50/50 allocation for their portfolio. The total amount of the investment into the portfolio is $10,000 – so each is equivalent to a $5,000 investment. During the quarter (or whenever rebalancing is scheduled), the stocks don’t do well and fall to 30%, or $3,000. The bonds, however, increased, and now make up 70% of the portfolio, keeping the total investment at $10,000.

At this time, the client would want to rebalance. The bonds would be sold off and the proportionate number of stocks purchased to get back to the original 50/50 balance of the portfolio. It can get a little trickier when there are other asset categories involved, which is often the case for investors with a financial advisor.

Asset allocation plays a very important role in rebalancing, but it’s not the only key player.

Allocation in Retirement and Investment Assets

A large part of asset rebalancing depends on asset allocation and location. You can’t effectively locate your client’s assets until you have a household-level asset allocation defined. Let’s look at that step-by-step, breaking it down and putting it in line with rebalancing activities.

Everything begins with a household-level asset allocation.

There are many different asset classes where investment funds can live – but a lot rides on the client’s goal and where they go financially.

- Stocks (Equities) – Equities are shares of ownership issued by publicly traded companies. These are traded on the stock exchange (NASDAQ, NYSE, etc.) Clients profit from a rise in share price or through dividends. These may be divided into market capitalization subgroups (small-cap, mid-cap, and large-cap).

- Bonds (Fixed-Income Investments) – Fixed-income investments are investments in debt securities that pay a rate of return through interest. These are often less risky than equities or other asset classes.

- Cash (Cash-Equivalent Accounts) – Cash or cash-equivalent investments are advantageous due to their liquidity. These types of investments are easily accessible and often considered “on-hand.”

- Real Estate (Tangible Assets) – Real estate investments and other tangible (or physical) assets are considered an asset class that protects against inflation.

- Futures (Financial Derivatives) – Future contracts, the forex market, etc., are considered financial derivatives. In other words, these are investments that are derived from another underlying asset.

- Retirement – Retirement accounts such as 401(k), IRA, Roth IRA, etc., are all different vehicles for saving for retirement (some more tax advantageous than others) but are important to note here because they will likely have a place in a client’s asset allocation.

When rebalancing, all these types of investments and accounts should be considered at the household level. Taking from one account and replacing it from another to help rebalance the entire account is the very basis of multi-account rebalancing or household-level rebalancing.

Managing portfolios and rebalancing across accounts in a unified managed household requires technology.

The Different Types of Portfolio Management

Asset allocation can be approached from many different angles. The important part is to create and balance the portfolio in a way that reflects your client’s goals. It should account for the risk tolerance and the investment period. These strategies may require rebalancing periodically.

- Strategic Asset Allocation: This portfolio management strategy involves a balanced combination of assets based on the expected return rates. The overall risk tolerance and investment period are also taken into consideration with strategic asset allocation strategies. This strategy also implies the buy-and-hold strategy with occasional rebalancing.

- Constant-Weighting Asset Allocation: If strategic asset allocation is the ultimate definition of buy-and-hold portfolio management, constant-weighting asset allocation is the polar opposite. This type of portfolio management hinges on the constant rebalancing of the portfolio – buying low and selling high. While there are no “rules,” most rebalancing in this category occurs when the original asset class mix moves within 5% of the original allocation.

- Tactical Asset Allocation: Tactical asset allocation is exactly as it sounds. A tactical move is meant to create a quick change before returning to normal. This portfolio management strategy is used when short-term opportunities present themselves. Once achieved, the portfolio often goes back to a strategic allocation.

- Dynamic Asset Allocation: Dynamic asset allocation is the opposite of constant-weighting. When an asset shows vulnerability, you sell in anticipation of further decrease and purchase those that show an increase.

- Insured Asset Allocation: For those who don’t want to see their investment fall below a specific threshold and want to have a level of active management, insured asset allocation provides that. It is the “safety net” of portfolio management strategies.

- Integrated Asset Allocation: When clients want their economic expectations and risk considered in their portfolio strategy, they want an integrated asset allocation (even if they don’t know it). This strategy includes some of the characteristics of the previous strategies, but never the ones that compete with one another, at least not at the same time.

Explaining an Asset Rebalance to Clients

Trying to explain the rebalance process to clients can be frustrating for them and your firm’s advisors. One of the best ways to explain why rebalancing is necessary is by using this simple explanation.

Let’s going to run through a general household approach to rebalancing.

First, we have our household asset allocation. For simplicity’s sake, let’s say it’s 60/40 stocks to bonds.

This quarter, tech stocks might have taken a nosedive causing your household asset allocation to fall to 50/50. But the client has a slightly more aggressive risk tolerance than that and wants to get back to the original ratio. Now, we need to rebalance.

Figuring out what to sell and what to buy can be challenging. Are you also trying to harvest losses during this process? It can get complex very quickly, but you need to take all these variables into account for the best interest of the client.

That’s where technology comes into play. And this is why we created the SEI LifeYield Multi-Account Rebalancing engine in the first place.

When looking at the overall portfolio goals, whether it is a 50/50, 60/40, or whatever split made between stocks and bonds, the rebalancing process will help keep that balance within the portfolio. When your stocks are doing well, you may see a portfolio at 55/45, so stocks are sold to purchase bonds to even it back to the 50/50 balance. That is essentially what rebalancing a portfolio is.

The point of householding rebalancing is to make sure that:

- The assets sold are done in a tax-efficient way

- Assets are located in the most tax-advantaged accounts

- We take the opportunity to harvest any gains or losses

When is the Best Time to Rebalance Assets in a Portfolio?

There are no rules about when assets in a portfolio need to be rebalanced. The choice to rebalance is up to the client and the advisor.

The general rule of thumb is a minimum of annually and a maximum of monthly.

A client shouldn’t just tuck away a portfolio thinking that they can save it for a rainy day. The idea of their portfolio is to provide them with financial stability in the future. Trying to rebalance more than monthly can seem excessive and cause unnecessary taxable events.

Whether you execute your rebalance monthly, quarterly, or annually, stick to your chosen timeframe moving forward.

But when you do rebalance, you want to ensure it’s done in the most tax-efficient way. This is the most important part.

Asset Location and Rebalancing

Asset location is just as important as asset allocation during a rebalance.

The goal of using asset location in rebalancing is to help minimize taxes throughout the process. That is why technology that executes household-level rebalancing is crucial to execution.

Rebalancing assets within the portfolio to maintain the optimal tax bill reductions is key to improving outcomes for the client, the advisor, and the firm. More client assets = more AUM for the advisor = more revenue for the firm. It’s a win-win-win.

Tying in Tax Harvesting

Tax harvesting, as mentioned above, can be integrated into the rebalancing process. Tax harvesting, in short, is using the client’s losses to help offset the gains. Tax harvesting helps to reduce the overall tax bill that the client will be liable for at the end of the year. SEI LifeYield’s proprietary APIs all work together to make tax efficiency a top priority for the client.

SEI LifeYield Multi-Account Rebalancing

SEI LifeYield makes it possible to execute rebalancing across accounts with the industry’s only true household-level rebalancing engine of its kind. SEI LifeYield technology can act as an overlay for rebalancing – adding household-level capabilities to your firm’s process. All this can be done without disrupting your advisor’s current flow.

The benefits of SEI LifeYield Multi-Account Rebalancing technology are:

- Rebalance Across Account Types – SEI LifeYield lets you take the household approach to rebalance assets. Account for asset location, minimize drift, and maximize the outcomes for advisors, investors, and firms. You can only find this with SEI LifeYield multi-account rebalancing.

- Avoid Replacing Technology – You can use SEI LifeYield with your existing rebalancing software. You don’t have to worry about replacing old technology, only adding SEI LifeYield as an overlay to strengthen your firm’s existing rebalancing processes. We don’t believe in disrupting your entire tech stack.

- Enhancing the Withdrawal Process – With each withdrawal recommendation, the rebalancing engine identifies mislocated assets. It executes the most tax-efficient rebalance to keep them in alignment with the client’s portfolio and target asset allocation.

- Identify Where Tax Harvesting Opportunities Exist – Ensure you are maximizing the outcomes for your clients by using the information provided to consider each opportunity to harvest gains or losses.

How Firms Are Using SEI LifeYield Rebalancing Engine

Our SEI LifeYield engine has been tested by some of the largest names in the financial industry. These institutions worldwide have benefited from coordinating accounts within a household and offering rebalancing at scale.

What variables do the SEI LifeYield algorithm include?

- Incorporate sell restraints

- Set gain budgets to make sure client tax brackets remain in place

- Implement asset location optimization practices

- Coordinate taxable, tax-deferred, and tax-free accounts

- Calculate the key statistics: After-tax returns, location scores, total realized gain or loss, drift, the approximate cost of implementation, and more

Rebalancing is only one piece of the tax efficiency pie. Not only can your firm benefit from the Multi-Account Rebalancing features, but it can also benefit from:

- SEI LifeYield Asset Location – which measures the tax efficiency of each client’s household portfolio. It provides the next best actions for reducing tax drag and quantifies the benefits in dollars.

- SEI LifeYield Tax-Smart Withdrawals – Optimizes withdrawals from multiple accounts by selling mislocated assets and coordinating each withdrawal so that each aspect is executed in the most tax-efficient way.

- SEI LifeYield Tax Harvesting – Used in conjunction with the asset location, rebalancing, and withdrawal technology to look for opportunities to harvest gains or losses.

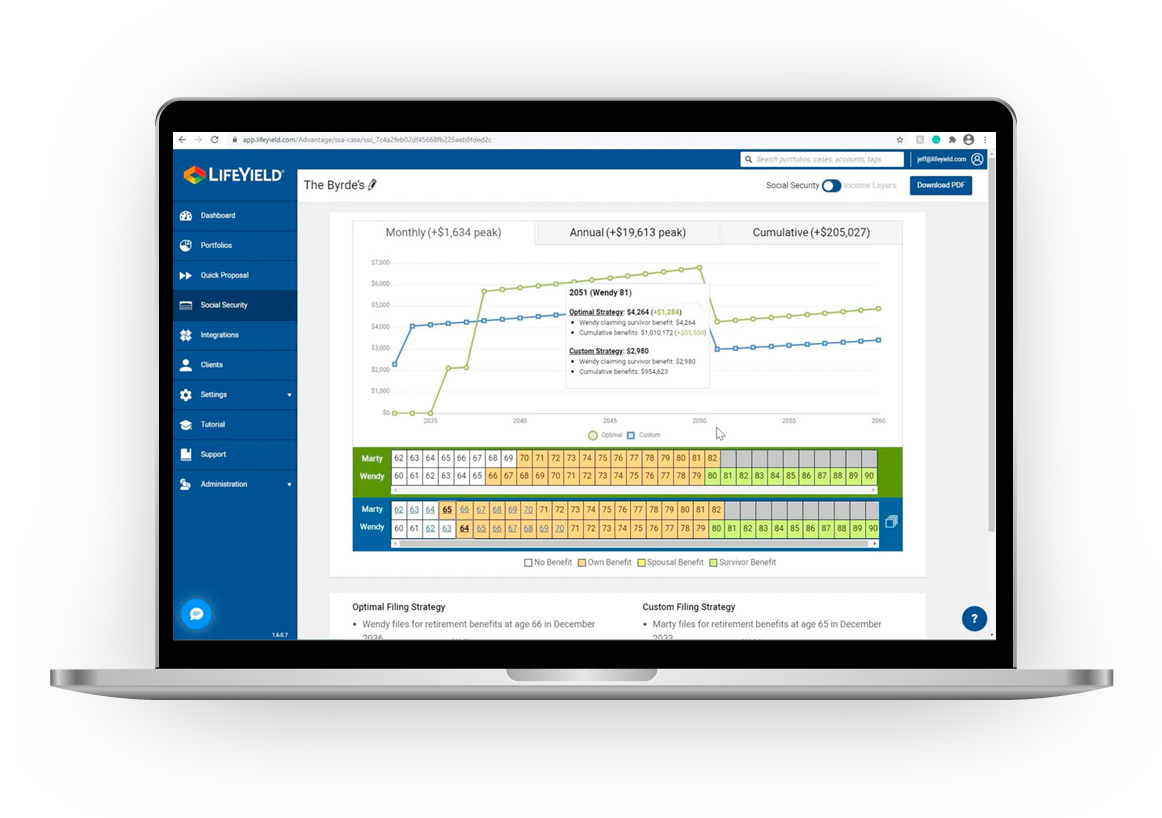

- SEI LifeYield Social Security+™ – Helps clients find the optimal filing strategy and coordinate their Social Security check with the rest of their retirement income streams.

Can Your Firm Benefit From Multi-Account Rebalancing Technology?

Most clients have a complex array of accounts and holdings. Managing these at the household level is the new gold standard in financial services.

To do this effectively, advisors and firms need software that can take all variables into account across the accounts and holdings of each client.

But beyond the time and accuracy that the technology provides, it also sets your firm up to handle the next generation of wealth. As young people grow in their careers, they will undeniably open numerous different accounts for different reasons. If your firm is set up to attract any new accounts and coordinate assets across them to potentially provide the client with more in retirement income, why wouldn’t they consolidate with your firm?

Multi-account is the way forward. Start your journey towards the Unified Managed Household.

For educational purposes only. This information should not be considered investment advice.