Identify the best path to maximizing retirement income for each household.

The only automated, personalized, and scalable retirement income solution.

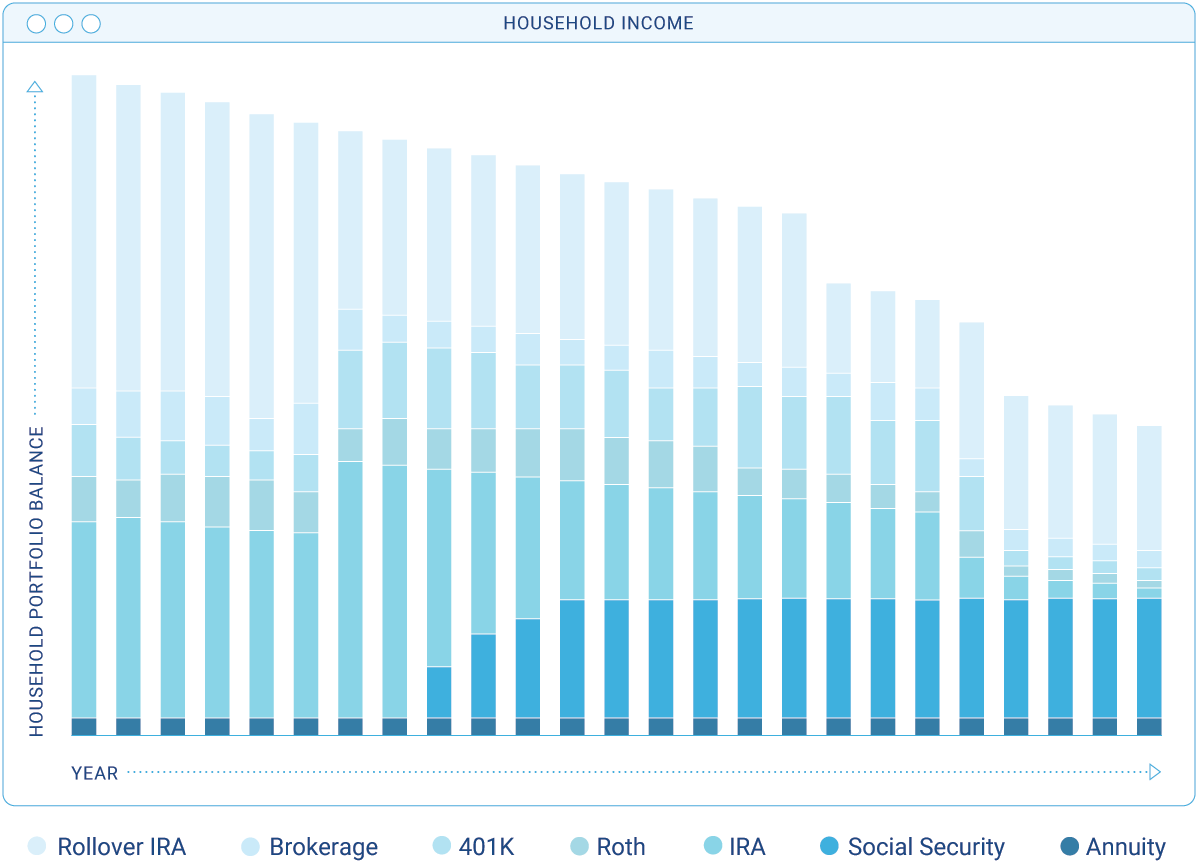

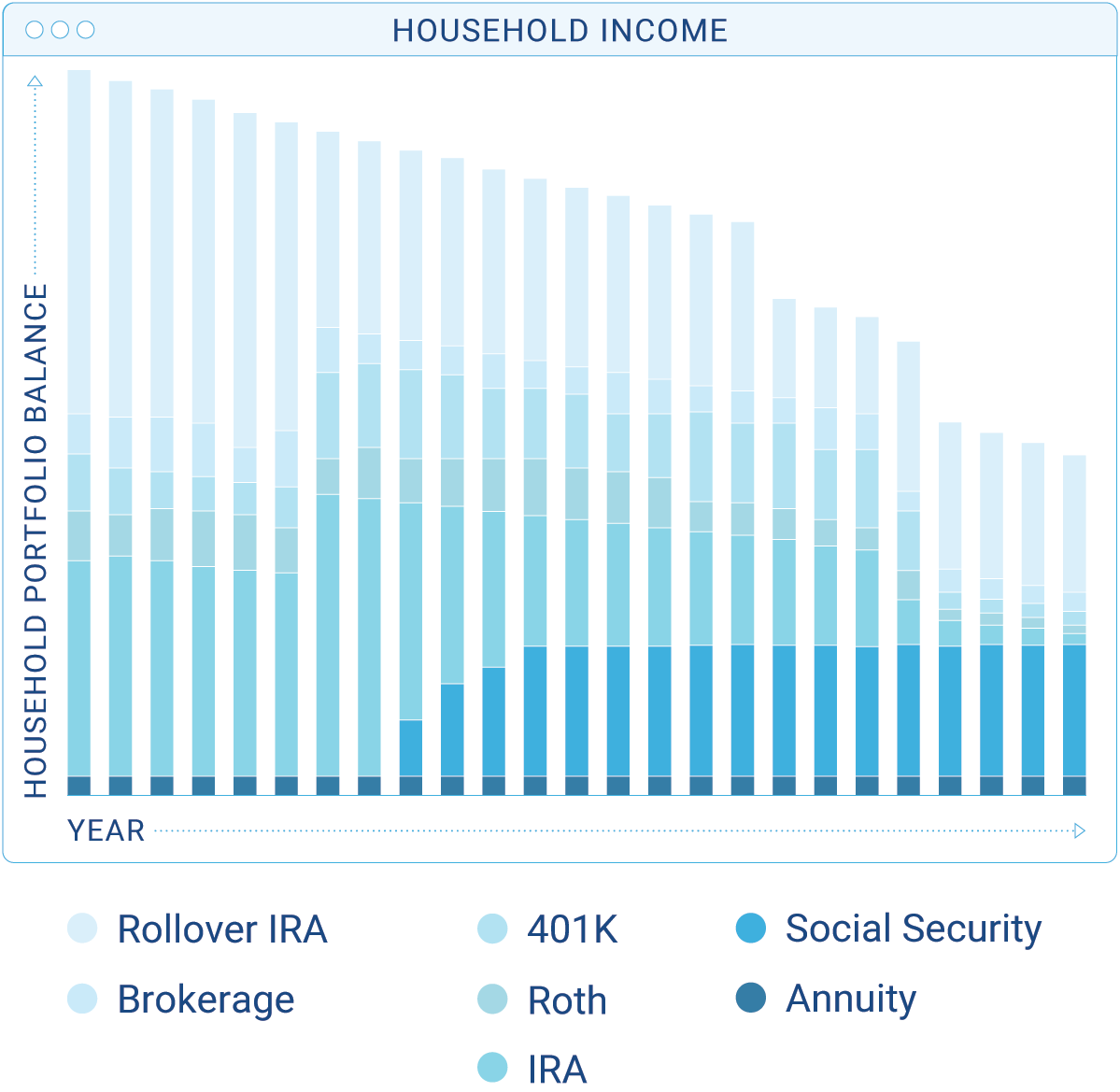

Deliver a blueprint for drawing down on a client’s assets account-by-account, down to the security.

Avoid the costly “rules of thumb” used by every firm that don’t take each client’s unique circumstances into account.

Create hyper-personalized decumulation plans for each client.

Identify the next best steps to draw down on a client’s assets by considering each client’s investment objectives while minimizing taxes.

Provide detailed tax breakdowns for state and federal for each step of decumulation.

Account for tax brackets, deductions, Social Security taxation, investment taxes, Medicare, personal exemptions, and more.

Adaptable to your firm’s preferences and evolving capabilities.

Firms can choose the level of detail, capital market assumptions, number of trials, and can customize the experience based on several variables.

Get to market faster by leveraging a modern, stateless API.

Deliver technology faster while controlling the user experience, user interface, and inputs/outputs to complement and enhance your proprietary solutions.

Industry-leading household tax management APIs

-

Asset Location

-

Multi-Account Rebalancing

-

Tax-Smart Withdrawals

-

Tax Harvesting

-

Social Security+

-

Retirement Income Sourcing