Improve Client Financial Outcomes with Tax-Smart Withdrawals

Clients expect the best possible financial outcome. That’s why they hire an advisor.

To achieve that, advisors need to be doing everything possible within their control. Cost, risk, tax, and Social Security being the four main levers advisors can use on behalf of clients. And all of these are components of a Unified Managed Household.

Many different factors come into play when looking into a client’s household portfolio. LifeYield doesn’t just look at the portfolio – it looks across the entire household of each client when executing asset location, rebalancing, tax harvesting, multi-account withdrawals, and Social Security maximization.

The goal is simple, find a way to make tax-efficient choices for your client’s accounts to increase their financial outcomes. These clients want your advice on their retirement accounts, and they likely don’t know how to organize assets across these accounts – meaning they don’t know the potential either.

The only way for your firm to successfully do this is to look across the unified managed household to see exactly what the client’s accounts can offer for the financial outcome. Then show the clients the potential impact in dollars and cents.

Where Does The Wealth Come From?

Over the years, clients pack away money in various accounts for “later on.” The accounts they can invest in are either qualified or non-qualified. LifeYield looks at everything to figure out where the best withdrawal strategy exists when it comes to withdrawals from your client’s investment portfolio. Before you can dig into these accounts, you must understand what a unified managed household is.

Unified Managed Household

With the technological advances made in the financial industry, managing multiple account types has never been easier. LifeYield leverages these technological advances to create an all-inclusive library of API capabilities that work on the household level.

A unified managed household is a portfolio of investments and protection products that are:

- Held in different account types

- Managed in a coordinated way, optimizing risk and tax

- Improving financial outcomes

- Quantifying the benefits in a dollar amount

There are three sure-fire ways to improve the outcome of a portfolio:

Taxes and tax-smart withdrawals are the way to improve the financial outcomes of clients. What do taxes do to unified managed households? Looking all across multiple accounts to find the most tax-efficient solutions is how LifeYield does it. Identifying every account with withdrawal potential and how withdrawing from it will affect the grand scheme of the household plays a major role. LifeYield uses multiple points of analysis to determine whether or not withdrawing, balancing, and reinvestment are necessary to achieve the various financial goals.

The Effects of Taxes on Wealth

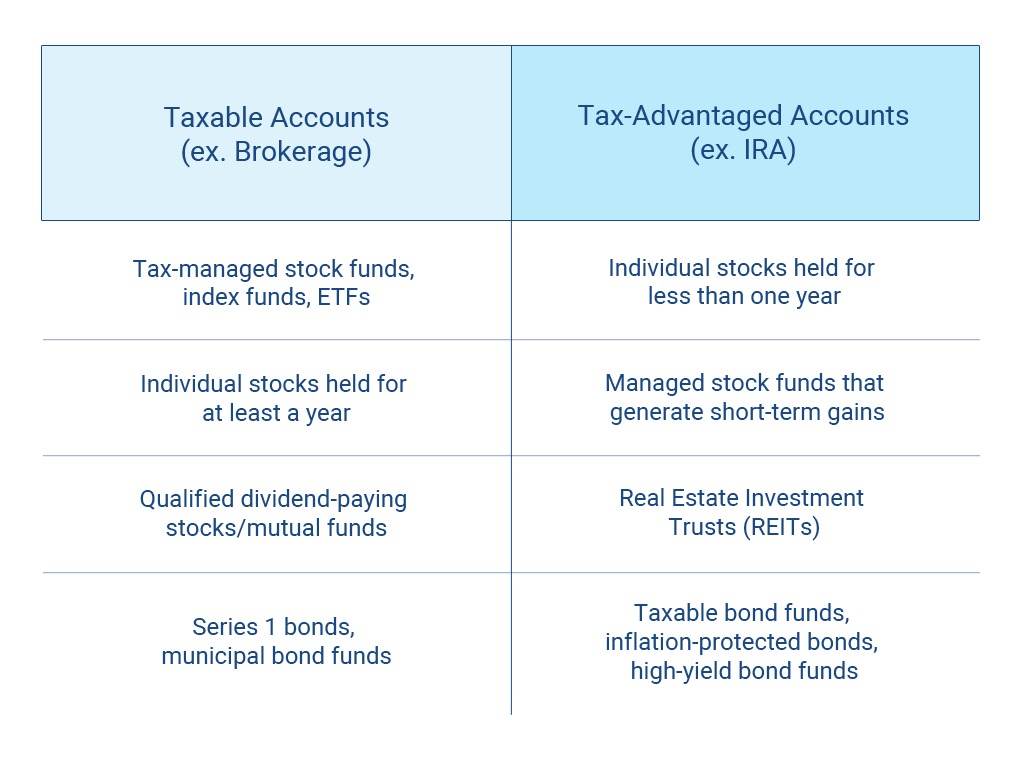

Accounts fall into tax-advantaged and taxable accounts. Taxable accounts do not have as many restrictions because they don’t offer many tax benefits. When clients hold investments in their accounts for longer than a year, they move into more favorable tax brackets. These include 0%, 15%, and 20% long-term capital gains, depending on the client’s tax bracket.

On the other hand, tax-advantaged accounts are those types of accounts that provide tax-deferred status or tax-exempt status. Accounts that fall into this category remain tax-deferred until the client decides to make withdrawals for retirement. Accounts like Roth IRAs are initially taxed, so when they are withdrawn, later on, they are exempt from being taxed again. As a part of entering this partnership with the government, certain constraints apply that limit contribution amounts and when and how you withdraw the money.

Depending on where assets (wealth) are located, you could see a decrease in the number of assets you have in real-time because of the reduction required for taxes at the time of withdrawal. Here is where the confusion between asset allocation and asset location occurs. Allocation is the investment that determines the proper ratio of assets to accounts for efficient investment. Location is determining where these assets need to be held – taxable or tax-advantaged accounts.

What Are Tax-Smart Withdrawals?

Approaching retirement, clients tend to make more withdrawals from their household accounts. Your clients also expect you to help them determine where these withdrawals need to come from to maximize their tax efficiency and ensure that they are retaining as much wealth as possible. LifeYield’s technology helps you with this. Our proprietary technology looks across the account and finds the optimal location to withdraw from while helping to rebalance the account at the same time.

Withdrawals and Taxes on Financial Portfolios

Your clients might need to make a withdrawal for any number of reasons. Many of these are for larger purchases – car, down payment on a house, a trip around the world, etc. No matter their reason, you are here to help them find where they can withdraw funds with as few tax consequences as possible. So, which accounts do they withdraw from?

Qualified Accounts

Qualified accounts are accounts that usually fall into the retirement account category. These accounts typically receive some special tax advantages when the money gets deposited. These offer your clients the following advantages:

- Contributions into these accounts can be deducted from the year’s taxable income in the year that they are made;

- Contributions and earnings for the investment can be tax-deferred until it is withdrawn; and

- Keeping the contributions in these qualified accounts allow the owner to delay paying taxes until they turn 70 ½ years of age when they have to begin taking the Required Minimum Distributions (RMD).

Non-Qualified Accounts

Non-qualified accounts are investment accounts that do not receive any special tax treatments. Investments made into these accounts can be for as little or as much as your client wants. The money placed into these accounts can be withdrawn at any time, and the money has already had income taxes paid on it.

Understanding Long-Term Capital Gains and Tax Brackets

The term “capital gain” is used to represent any profit made from selling off an asset. Short-term gains are taxed as income because the assets are usually held for a year or less. On the other hand, long-term gains are assets that have been held for longer than a year before sale. Long-term capital gains fall into an entirely different tax bracket than traditional income taxes.

| Long-Term Capital Gain Tax Rate | Single | Married, Filing Jointly |

|---|---|---|

| 0% | $0 – $40,000 | $0 – $80,000 |

| 15% | $40,001 – $441,450 | $80,001 – $496,600 |

| 20% | $441,451 or more | $496,601 or more |

Here is how long-term capital gain tax rates work:

- Scenario 1: 2020 was not the best year for a married couple that comes in to withdraw from an account to purchase a car. Together, they only made $54,000 for the year. The car they are looking at is $16,000. Still, they plan on withdrawing an additional $7,000 for the insurance increase and other minor home expenses. The total income for the year would equal $77,000. What advice might you have for them?

- Scenario 2: Your client is single, with a total yearly income of $250,450. They come to your firm because they want to withdraw from an investment account to pay cash for a down payment on a home. They plan to take $83,000 from a long-term account for the down payment, which will make their total taxable income $333,450. They are still well within the 15% tax bracket, with some room to withdraw more at the same rate if they wanted to do so. How would you have your client proceed?

One solution for both of these clients would be to withdrawal up to the yearly threshold and invest those funds into a Roth IRA conversion. Roth conversions are an effective way to focus on retirement planning if your client has time for that invested money to grow.

Smart Investing Strategies for Client Futures

Retirement accounts play a large role in the overall unified managed household for a client. These accounts are what will have to supplement the Social Security benefits that your client will eventually need to apply for, which will likely be significantly less than the income they are used to now. If this is the case, their retirement investments will be the only thing to hold them over unless they continue to work.

There are many tax rules out there, rules that your client cannot be expected to understand. Handling multi-account portfolios can be complicated without the right technology to make smart investing strategies a reality. Firms can now take advantage of LifeYield’s offering to help create the smartest investing strategies for their clients (present and future).

The Major Challenges Facing Your Firm

Trying to organize a household with multiple accounts is not a simple task. It doesn’t matter if you have the best advisors in the industry – trying to handle these accounts without leading technology is next to impossible. It just takes up a lot of time, and there are so many different scenarios to consider.

With the right software (like LifeYield), your firm and advisors have the advantage – looking across a household and coming up with multiple scenarios and game plans on how to be efficient.

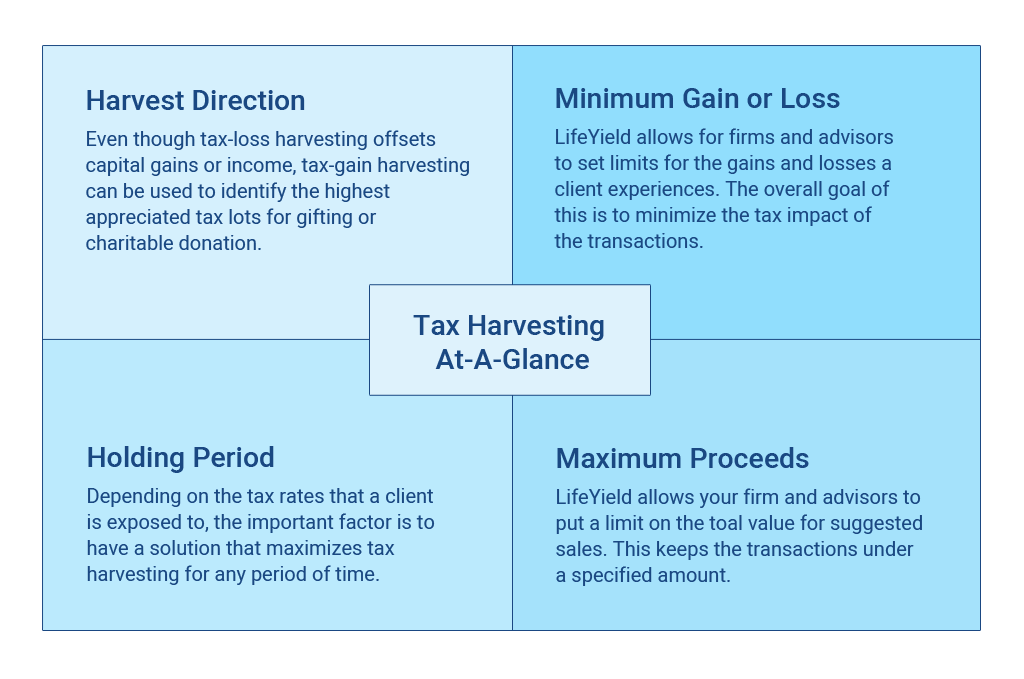

What LifeYield’s Tax Harvesting Engine Does For Client’s Financial Outcomes

The goal of tax harvesting is to balance out the gains and the losses for tax purposes. It is important that wash sales are avoided. Otherwise, the entire process is literally a wash – but we will get into that shortly.

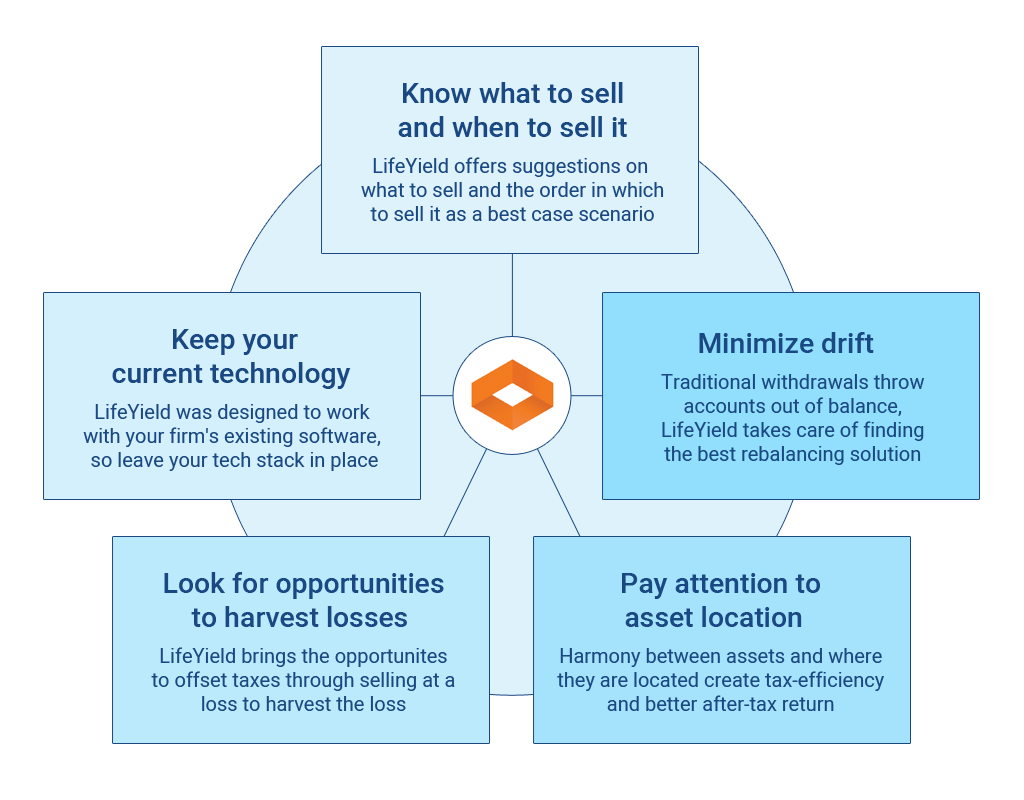

Here is a glance at how the engine works in your client’s favor:

A wash sale is a rule created by the IRS to prevent taxpayers from claiming artificial losses. The rule states that a loss cannot be realized if the taxpayer replaces the sold securities within 30 days of the sale. Wash sales frequently happen when there is no communication between portfolio managers who handle multiple accounts for one client.

LifeYield helps your firm and advisors prevent wash sales by scanning the client’s entire household of accounts. Here is how a wash sale might look:

Firm CBA handles two investment accounts:

- XYZ: 107 shares

- ABC: 50 shares

Firm IHG handles three more accounts:

- CDE: 125 shares

- FGH: 100 shares

- GHI: 125 shares

On November 1, Firm IHG sells 100 shares of GHI to harvest the loss for tax purposes. On November 28, Firm CBA sees an opportunity to purchase stock at a low rate and acquires 100 shares of GHI.

Now the client’s accounts for the firms look like this:

Firm CBA investment accounts:

- XYZ: 107 shares

- ABC: 50 shares

- GHI: 100 shares

Firm IHG investment accounts:

- CDE: 125 shares

- FGH: 100 shares

- GHI: 25 shares

Firm IHG tries to realize the loss from GHI at tax time, but it is rejected because Firm CBA bought the stock within 30 days for the same client. Due to this, the firm cannot realize that loss, and it is considered a wash sale.

Overall, the use of tax harvesting as means of improving the financial outcomes of your firm’s clients can be extremely effective. Nobody is getting out of paying the taxes they are required to pay. That is not what tax harvesting is about. We are advocates for paying our fair share of taxes. Tax harvesting just helps to offset the amount of taxes paid overall.

The beauty is the combination of all the LifeYield products working together to create a more tax-efficient and positive outcome overall for your client’s investments.

How LifeYield’s Services Improve Client Financial Outcomes

LifeYield’s technological library of service engines offers firms and advisors the upper hand when handling the tax efficiency of accounts. In the end, LifeYield offers a win-win-win for all parties involved.

- Asset Location: Asset location technology reduces the drag across a client’s household of accounts and quantifies the benefits with a dollar sign. Thanks to the proprietary algorithm, tax-smart choices can be made in a matter of seconds.

- Multi-Account Rebalancing: Traditional means of rebalancing look at each account individually – LifeYield looks at all accounts as a household when rebalancing to find the tax-efficient solution that minimizes drift and paves the way for the other engines – allowing harvesting and tax-smart choices at the same time.

- Tax-Smart Withdrawals: LifeYield looks at a client’s household and pinpoints the accounts that are beneficial for withdrawal when they need the money. It also helps to maximize the returns and minimize tax liabilities across the accounts.

- Tax Harvesting: Going in either direction, LifeYield can identify the gains and losses for prime tax LifeYield makes it possible for tax harvesting to be implemented at a household level and create an automated process.

When it comes to improving the overall client financial outcome, LifeYield’s tax-smart withdrawals have it covered. Using a unified managed household approach – instead of a unified account makes it possible to minimize the tax burden while maximizing the future income, including retirement.

Monthly insights from our Chief Growth Officer, Jack Sharry

Get exclusive insights and interviews from around the industry

By

By