The Benefits of a Tax-smart Asset Location Strategy

The world has changed but investor goals have not.

Smart advisors report they are reinforcing their value by showing investors how to put portfolios back on track and improve outcomes through tax-smart household portfolio management.

And the first place to start for long term success is asset location – a timely topic after recent markets have turned portfolios upside down.

Asset Location Maximizes Retirement Income

Maximizing retirement income starts with a tax-smart asset location. By maintaining an optimal asset allocation and asset location strategy, after-tax assets accumulate more rapidly.

Morningstar says investors can improve outcomes by 183 basis points per year by combining asset location and dynamic withdrawals. But advisors report generating an income from a full household portfolio of accounts is “hard;” and a “thumbnail exercise at best.” Software now exists to provide guidance to the advisor to help maximize a client’s income.

The Importance of Quantifying Financial Benefit

if a tree falls in a forest and no one is there to hear it, did it make a sound? While many advisors work to optimize asset location and maximize income unless the financial benefit is quantified, did it happen? Quantifying the value of tax-smart asset location and the optimal sequence of withdrawals across multiple accounts and income sources is vital to improving results, building investor confidence, and demonstrating advisor value. It also suggests the next best action, or trade, to continually quantify value beyond investment performance.

Increases Retention, Consolidation, Referrals, Revenues, and Profitability

The mark of the prudent investor and wise advisor is to seek sound ways to improve portfolio outcomes through all market cycles. Tax savings equate to increased assets and revenues for the advisor. As EY highlights, investors can see a 33% improvement over an investor’s lifetime. That translates to a dramatic improvement in advisor revenues as fewer assets are needed to pay taxes. And as retained assets grow and compound, it’s a win for both investors and advisors.

What’s the Value of Asset Location?

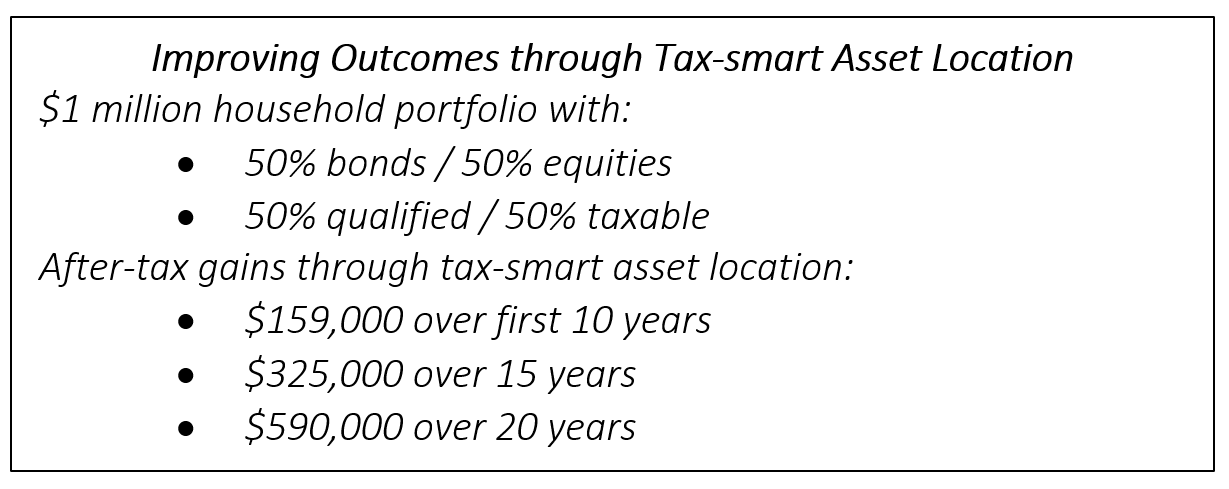

Vanguard, EY, Morningstar, and Envestnet have all done studies showing asset location can improve investor outcomes by 30-70 basis points per year. The following shows just how impactful asset location can be for a household portfolio:

Multiple studies have shown the #1 objective for investors is creating dependable retirement income. Managing all assets in a risk-smart, tax-smart way, starting with asset location, and then followed by creating an optimal sequence of withdrawals helps both the client and the advisor achieve their objectives.

Monthly insights from our Chief Growth Officer, Jack Sharry

Get exclusive insights and interviews from around the industry

By

By