Two major mistakes people make when filing for Social Security

Emotion clouds many financial decisions. Education and financial coaching could help many clients avoid mistakes, particularly with Social Security.

Statistics show Americans are in the dark about the factors determining their Social Security benefits. That plus a never-ending news cycle of doom and gloom, rule-of-thumb thinking, and investors heeding the advice of friends or family, and you have a recipe for poor decision-making.

In this newsletter, we’ll cover two common mistakes Americans make when filing for Social Security.

Mistake #1: Misjudging the potential of a long life

Recently a colleague shared a story: Her husband filed for Social Security ten years ago at his Full Retirement Age (FRA), not taking advantage of Delayed Retirement Credits (DRCs).

When she asked him about it recently, his response was (in jest, partly): “It was based on my actuarial calculations. Both my grandfathers died in their late 60s, and my father had a heart attack and died at 71. How long am I going to live?”

The good news is that my colleague’s husband has far exceeded his uninformed longevity analysis. However, his failure to think twice before filing had two pitfalls:

- He risked reducing his lifetime income from Social Security by not taking advantage of DRCs.

- If his “actuarial” estimates had turned out to be accurate, he would have left his widow with reduced survivor benefits.

Sadly, this happens too often.

Why do people make bad decisions about their life expectancy?

Finger-in-the-wind decisions – Many assume their lifespans will be roughly equivalent to their parents. After all, isn’t that why every doctor asks for a family medical history? But our parents’ life expectancies were shorter than ours today.

Brain failure – In a recent Financial Advisor Magazine article,” Steve Gresham explained this: “The human brain is not wired for long-term planning — of any kind. We have trouble with abstract concepts. We can’t process ‘odds.’ We process only what we can see or feel or deposit or fear. Clients get in big trouble with retirement planning because they hear the numbers but don’t really ‘see’ themselves forward.”

A disregard for the facts – Simply looking at the Social Security Actuarial Life Table (see the table) shows that a 62-year-old man’s life expectancy is slightly over 20 years, which means age 82. A female who reaches 62 has a life expectancy of more than 23 years, or age 85. Indeed, this isn’t the only factor for planning (some clients will have health conditions, for example, that affect their life expectancy), but it can serve as a guide – if you choose to research and get the facts.

Period Life Table, 2019, as used in the 2022 Trustees Report

| Age | Male | Female |

|---|---|---|

| 55 | 25.69 | 29.06 |

| 56 | 24.89 | 28.19 |

| 57 | 24.09 | 27.33 |

| 58 | 23.31 | 26.48 |

| 59 | 22.53 | 25.63 |

| 60 | 21.77 | 24.79 |

| 61 | 21.01 | 23.96 |

| 62 | 20.27 | 23.14 |

Mistake #2: Filing early because of a perceived need for income

Many (erroneously) believe that retirement and filing for Social Security should be simultaneous. “I retire at 64; I file for Social Security at 64.”

There are a few possible reasons for that. Some may be unable to imagine paying their bills without an employer’s paycheck. Others may think they can’t or shouldn’t touch their retirement savings until they’re required to begin withdrawals. That age is 73 as of this year, and it will rise to 75 in 2033.

And almost everyone who has paid taxes to fund Social Security is tempted to “cash out” by filing for benefits as soon as they’re eligible.

What folks don’t consider are the following:

- The reduction in benefits that come with filing before their FRA. It is significant and can mean thousands of dollars in lifetime income from the Social Security Administration.

- The potential lifetime benefit of deferring Social Security past their FRA, perhaps until age 70.

- If they’re married, it’s vital to evaluate each spouse’s benefit and develop a strategy as a couple.

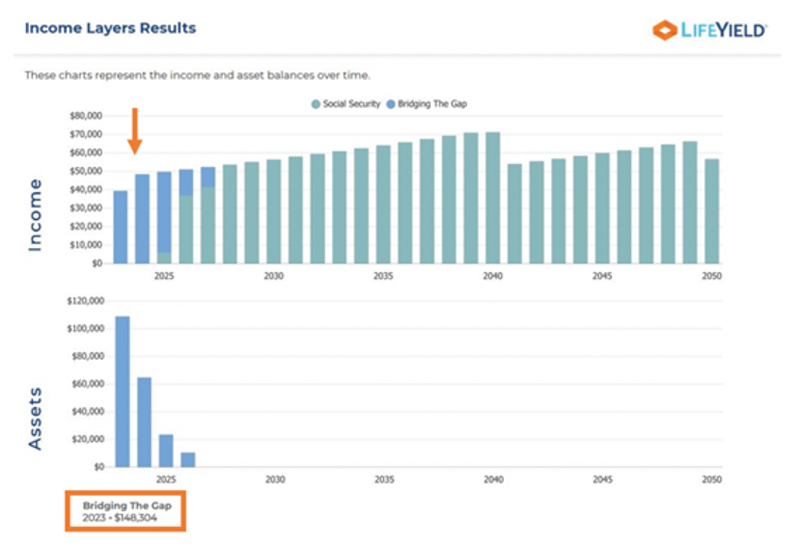

In many cases, clients may be able to delay Social Security and close the interim income gap with money from savings. It may feel risky to clients, but you can use Social Security+ with Income Layers software to estimate the lifetime value of delaying Social Security filing.

Sample client case for Social Security optimization and closing the income gap

Steve, 68, and Kelly, 63, both retire this year. They had decided they will both collect Social Security — after all, he’s reached his full retirement age, and she’d be eligible for a reduced benefit.

Fortunately, before they pulled the trigger, Steve and Kelly consulted their financial advisor, who ran an analysis using Social Security+ with Income Layers. It allowed them to use key information — dates of birth, earnings history, life expectancy ages — to see what their benefit values would be over their lifetimes in different scenarios.

Then, using information about their anticipated annual income needs, the software showed them what their “income gap” was while they delayed filing for Social Security so they could optimize their lifetime benefits.

Ultimately, they decided:

- Steve would wait to file until he was 70. Kelly would file two years later at her full retirement age, 67.

- Their projected lifetime income with this filing strategy would be $143,562 more than if they filed when they planned before consulting their advisor.

An analysis of their assets and income needs revealed an income gap of almost $149,000 total in the years before Kelly files for Social Security. They need to find the money somewhere, possibly through part-time work or savings.

The couple, fortunately, has retirement savings — a combination of brokerage accounts, 401(k)s, and a Roth IRA — that they can tap. And they expect asset growth will help offset their income needs.

Visualization of Bridging the Gap

Visualization of Bridging the Gap

In conclusion

Many people don’t understand the risk longevity presents to their financial health in retirement. Many factors contribute to longevity, including lifestyle, workplace, and access to healthcare. Talking with an advisor and using financial planning tools with a longevity calculator is superior to any “rule-of-thumb” approach.

Additionally, an advisor leveraging innovative technology can help clients consider their options — for Social Security benefits and their retirement income needs — that may ultimately protect them from running out of money in their later years.

A conversation about “bridging the gap” can help clients get the most out of their Social Security income, retire when they want, and possibly reduce future taxes. Technology can help facilitate understanding and guide investors to make sound decisions.

Monthly insights from our Chief Growth Officer, Jack Sharry

Get exclusive insights and interviews from around the industry

By

By