Where are Baby Boomers Coming From?

Their kids have been asking this for years.

Seriously, today’s waves of retirees have witnessed the good, the bad, and the ugly in their financial lives. Even the affluent worry about having money to last their lifetimes. It’s stressing them – and straining advisors’ capacity.

Advisors tell us their calendars are wall-to-wall with client meetings and calls. Baby boomers have largely had to be “do it yourself” retirement savers. Many haven’t invested or put away enough. Others don’t know how to turn their savings into an income stream.

Looking about for reliable income, they ask, “When can I file for Social Security?” Understanding what your clients have experienced can help you put their minds at ease and chart the best steps toward optimizing Social Security for retirement income.

How Did They Get Here?

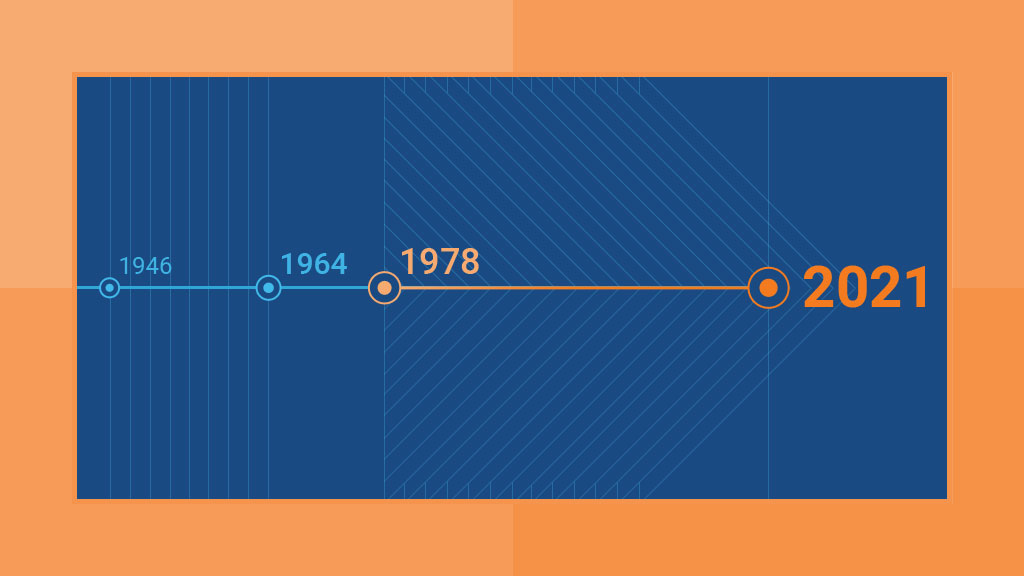

Boomers were in college or starting careers when the so-called “accidental retirement revolution” began. That was in 1978. Congress passed the Revenue Act giving employees a tax-free way to defer compensation from bonuses or stock options and added Section 401(k) to the Internal Revenue Code. (Individual retirement accounts (IRAs) had been created four years earlier for workers without pension coverage.)

Witnesses to the revolution have said they didn’t foresee how defined contribution plans would eclipse pensions and become the primary ways to save for retirement. But here we are.

We know what’s happened since: Many with employer-sponsored defined contribution plans saved for retirement and deferred taxes on part of their income – with outstanding results, owing to a strong economy and well-performing equities markets.

But not everyone.

Many put off saving for retirement because they needed money to pay for living expenses, homes, college educations, elder and childcare. Those who eventually started saving were limited in how much they could invest in tax-advantaged accounts each year. And, fewer years in the markets curbed the growth of their investments.

Economic crises in every decade since 1978 set many people back and disrupted retirement planning. Some never fully understood the defined contribution plans their employers offered or the consequences of not participating or not saving enough. Prolonged periods of unemployment meant, for some, tapping retirement savings earlier than planned.

The Rosy Glow of Social Security

Now, it’s time for those present at the retirement revolution to, well, retire. And Social Security looks inviting.

Depending on individual situations, Social Security represents to clients:

- A vital plug for the gap between the income they can draw from savings and investments and their daily living expenses, including health care.

- A supplement to the income they draw from pensions (if they’re fortunate), investments, savings, or defined contribution plans.

- An entitlement they feel they’ve earned through years of paying taxes into the trust fund.

- All the above.

No matter what category retirees fall into, almost every single one arrives at a decision point on when and how to file for Social Security. Even people who otherwise are financially savvy and successful often make a choice they later regret.

Decision Point: Social Security. What and How Much Do Your Clients Know?

The 2021 Nationwide Retirement Institute® survey found that only 16 percent of respondents knew the age at which they qualify for full retirement benefits from Social Security. And fewer than one in ten know all the factors that determine the maximum Social Security benefit someone can receive.

No one can blame people for not understanding the rules governing Social Security benefits. There are 2,700 of them! Nevertheless, people make choices without knowing some of the most important factors, including the hazards of electing to file early.

Frankly, I’m less worried about the solvency of the Social Security fund than I am about poor financial literacy among retirees and their need for expert financial advice.

There is a silver lining: What people don’t understand, advisors can explain. And financial technology, starting with LifeYield Social Security+, supports conversations with easy-to-illustration scenarios of Social Security filing options, customized by the client.

In fact, raising the need for a Social Security filing strategy with clients in their 50s and 60s can lead to more expansive discussions on their needs for asset management and income-generating products, such as annuities and life insurance. I have five tips for talking to clients about Social Security to help you do just that.

Monthly insights from our Chief Growth Officer, Jack Sharry

Get exclusive insights and interviews from around the industry

By

By