Why We Need to Have More Conversations About Social Security

Welcome to the inaugural edition of The Retirement Environment Newsletter. Each month we’ll share ideas, best practices, and strategies that highlight the importance and benefits of engaging investors on the topic of Social Security and retirement income. We’ll also “Ask Alyson”, our resident Social Security expert/nerd, challenging questions about the crazy and confusing rules in the Social Security puzzle.

These Numbers Show Why the Social Security Conversation is Important

In my role at LifeYield, I have the privilege of working with some of the largest firms in the country, including wirehouses, insurance broker-dealers, and others. I spend much of my days engaged with these firms, their advisors, and even their clients to convey the importance of optimizing Social Security and the crucial role that technology plays in that conversation.

The firms we work with at LifeYield make a huge difference for their clients. Over the last three years (2020-2023) firms and advisors leveraging LifeYield’s Social Security+ tool have helped clients and prospects identify BILLIONS in Social Security income.

Using our tool, advisors have:

- Engaged more than 215,000 clients and prospects.

- Identified almost $35,000,000,000 in potential income from Social Security.

- Increased Social Security income by an average of $159,870 per household.

These are real, concrete numbers that have made a monumental impact on many families entering retirement. The reality is that Social Security is the baseline of retirement income for many Americans. Advisors and firms who lead this conversation have shown that it will strengthen client relationships as they progress through retirement.

Taking all this background into account, I thought a good place to start would be to discuss why, as an industry, we tend to undervalue the Social Security dialogue, the cost to the investor of not having the conversation, and how technology helps identify where the opportunities are for firms and advisors.

Why do we avoid the topic?

In my day to day, I hear two main reasons why advisors don’t engage investors on Social Security.

- “It’s complicated, I don’t want to give bad information.” It is true, Social Security is governed by over 2,700 rules and has many nuances. What complicates matters even further is the difficulty of getting consistent guidance from the Social Security Administration.

- “My clients have enough savings, they don’t need to worry about Social Security.” This is a common misconception. In fact, for most Americans, Social Security income is the foundation of their retirement income.

What is the cost to investors?

Americans are still in the dark when it comes to filing for benefits, as evidenced in Nationwide’s 2022 Social Security Consumer Survey, where only 7% correctly identified all of the listed factors that determine the maximum Social Security benefit someone can receive. Additionally, the survey shows that a large knowledge gap exists on general Social Security topics.

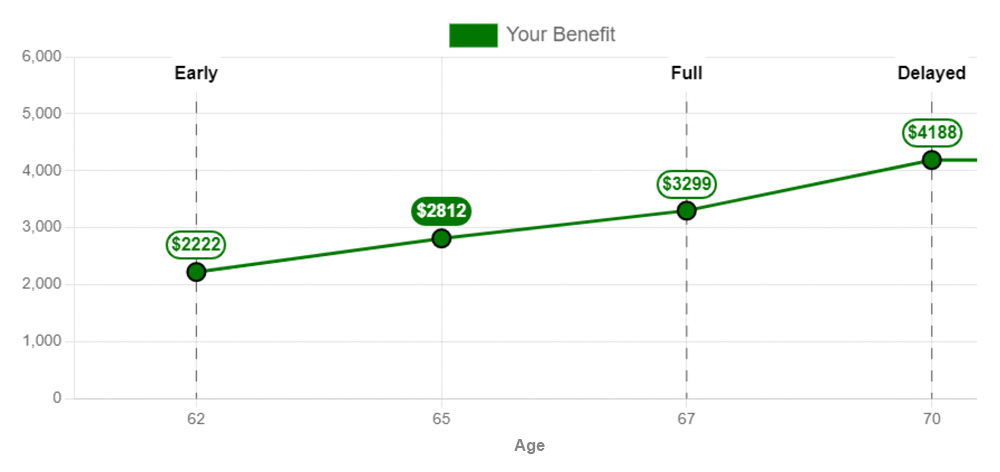

Not seeking professional advice regarding how to optimize benefits can be very costly. There is a cost associated with both filing for benefits before Full Retirement Age (FRA) and not taking advantage of Delayed Retirement Credits (DRC). The graphic below illustrates it (directly from ssa.gov).

In the above scenario, filing at 62 vs. FRA reduces monthly income by $1077 or over 33%, illustrating how an investor can be penalized for starting early. And the difference between filing at FRA and 70 represents a monthly increase of $889 per month or 22%. I’m not by any means saying that everyone should defer. But I am highlighting the importance of the conversation and why every advisor and client should run the analysis.

Technology + Human Advice = Improved Outcomes

The Nationwide survey I referenced earlier stated that 66% of responders have an interest in talking to a financial professional about how to use different income streams to supplement Social Security. As an advisor, it’s very difficult to have this discussion without technology to guide it.

Our clients tell us that demonstrating value and expertise often leads to a broader discussion about retirement income. An investor thinks, “this person knows a lot about Social Security, I wonder how it works with my other investments.” Technology can help you cover all ends of this conversation using graphs and interactive screens to show clients what they want to know. Investors need guidance and it’s our responsibility to provide it.

If you have any questions about Social Security and filing at the right time, email me at jeff@lifeyield.com and we’ll include it in our next newsletter.

Monthly insights from our Chief Growth Officer, Jack Sharry

Get exclusive insights and interviews from around the industry

By

By